Tenant Property Protection® is not just better, it’s smarter.

No state insurance licensing required

Earn as much as you want to sell

Available in all 50 states

Replacement cost – no deductible

Quick claim settlement target

Live, on-line training

Easy administration

Compatible with industry software

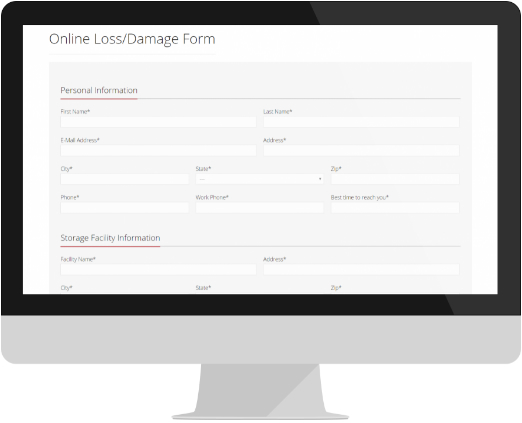

With Tenant Property Protection® we make it easy for you, as a self storage owner, to add real value to your business. Training is online. Just log-in, learn the best ways to sell, and you’re on your way. It’s that simple. No errors/omissions insurance required. Claims can be submitted online at www.tppclaims.com to make the entire process virtually seamless.

Since 2009, Tenant Property Protection® Plans have been helping owners/operators and managers of self storage facilities protect just about anything a tenant using self storage might store. It’s simple. Profitable. And ready to cover almost any loss your tenant might experience.

Sign up with TPP and say, “R.I.P. Insurance!”

Tenant Advantages:

Tenant Property Protection® eliminates all of the headaches, hassles, paperwork and broken promises of tenant insurance claims.

What do we cover?

Loss or damage may be caused by, but not necessarily limited to:

- Fire, explosion, smoke, or hail

- Burglary, vandalism, or malicious mischief. (Specific provisions applying to burglary claims)

- Roof leak or water damage. PLEASE NOTE: Flood, surface water, underground water or water that backs up through or overflows from a sewer, drain or sump or accidental discharge of substances from within plumbing, heating, air conditioning or fire protection system is NOT covered

- Windstorm that first causes damage to the building

- Collapse of the building where your property is stored

- Non-flammable inventory for businesses conducted away from the facility

- Rodent damage (covered up to $500)

We also recommend each tenant maintain and provide a list of inventory records and documentation to establish a base line of stored property in the event of a loss. We have created a web application tool to easily upload all documentation.