Take One Easy Step To Protect Your Property & Your Tenants!

It's not just better than insurance, it's smarter.

VOTED ON BY INDUSTRY PROFESSIONALS

With Tenant Property Protection®.

3 Easy Steps

Consider

What is Tenant Property Protection ® and why it's smarter?

Compare

Compare Tenant Property Protection® VS "The Others".

Commit

Sign up with Tenant Property Protection® and say, “R.I.P. Insurance!”.

TPP SECURE™

Our TPP Secure™ is our Lease Compliant Protection Plan that provides content protection for your tenants stored property against loss or damage. The plans are better than relying on homeowner’s insurance with NO deductible, NO depreciated value (we pay replacement cost) and NO worry of a premium rate increase in the event of a claim.

RV PARK 'N' PROTECT™

Our pioneering RV Park 'n' Protect™ Deductible Reimbursement Plan provides comprehensive protection for your tenant’s outdoor property like RVs, boats, autos, trailers and more that can be exposed to damage from on-site accidents, burglary, vandalism, smoke/fire, and includes content coverage starting at $500 for theft or loss/damage on-site and off-site. Learn More →

MOBILE CONTAINER PROGRAM

Many people assume their Homeowners or Renter’s insurance policy covers their belongings during the moving process. But this is often not the case. Even if their items are covered by their policy, our TPP Mobile Container Protection Program is their best option for extra peace of mind. From the Storage Facility, in transit and to your new location. We've got you covered. Learn More →

Tenant Property Protection® is not just better, it’s smarter...

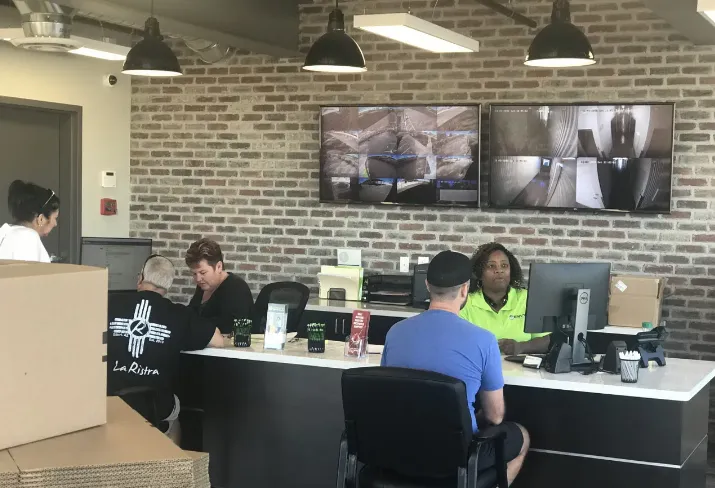

With Tenant Property Protection® we make it easy for you, as a self-storage owner, to add real value to your business. Training is online. Just log-in, learn the best ways to sell, and you’re on your way. It’s that simple. No errors/omissions insurance required.

YOUR BENEFITS

No State Insurance Licensing Required

No Errors / Omissions Coverage Needed

Earn As Much As You Want to Sell

Available in All 50 States

Replacement Cost – No Deductible

Quick Claim Settlement Target

Live, Online Training

Easy Administration

Compatible With All Industry Software

Quick Connect

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. You can reply STOP to unsubscribe at any time.

Quick Connect

Corporate Office

Tenant Property Protection, LLC

1838 W. Parkside Lane, Suite 200

Phoenix, AZ 85027

Contact Info

Quick Connect